AVIVA IS TAKING A RISK BY PAYING TOO HEFTY AN AMOUNT TO BUY AMERUS

When escapades are eternally accursed, no matter what you do, there’s lit tle that can effect a good outcome. Right from Aviva’s infamous beginnings in 2000 by the merger of the fraudulent CGU with Norwich Union to its overhyped $31.4 billion bid for UK’s insurance giant Prudential in March 2006, its credentials have always been doubted! But the wounded tiger is on the prowl and has its eyes currently set on the USbased life assurer, AmerUS. Despite having just $2.52 billion cash in its kitty (as on December 31, 2005), it has declared a consideration of $2.9 billion for the buy on July 13. Excluding debt and internal accruals, it has raised $1.66 billion through a share placement for the acquisition.

tle that can effect a good outcome. Right from Aviva’s infamous beginnings in 2000 by the merger of the fraudulent CGU with Norwich Union to its overhyped $31.4 billion bid for UK’s insurance giant Prudential in March 2006, its credentials have always been doubted! But the wounded tiger is on the prowl and has its eyes currently set on the USbased life assurer, AmerUS. Despite having just $2.52 billion cash in its kitty (as on December 31, 2005), it has declared a consideration of $2.9 billion for the buy on July 13. Excluding debt and internal accruals, it has raised $1.66 billion through a share placement for the acquisition.

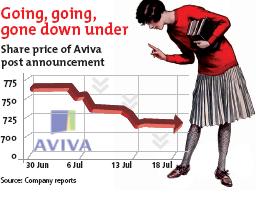

Richard Harvey, Group CEO, Aviva states the deal “provides the platform for significant profitable growth.” With 77 m illion Americans set to hit retirement age shortly, the deal looks positive in the US long term savings market. But analysts are questioning the wisdom behind the move as share prices slipped to a 7-month low to close at 691 pence on July 16, 2006. Kevin Ryan, analyst, ING critically comments, “They have gone for it (AmerUS) as Prudential was not available.” According to the concept of European Embedded Value (EEV) – a measure of a life insurer’s worth to a shareholder, Aviva is paying 1.9 times EEV for AmerUS, which is much more compared to the 1.6 times EEV that was paid by France’s AXA for Winterthur. So is Aviva paying too much? Well, certainly they are; but then perhaps they feel there won’t be a third time. Now wait! Is Aviva reinsured?

illion Americans set to hit retirement age shortly, the deal looks positive in the US long term savings market. But analysts are questioning the wisdom behind the move as share prices slipped to a 7-month low to close at 691 pence on July 16, 2006. Kevin Ryan, analyst, ING critically comments, “They have gone for it (AmerUS) as Prudential was not available.” According to the concept of European Embedded Value (EEV) – a measure of a life insurer’s worth to a shareholder, Aviva is paying 1.9 times EEV for AmerUS, which is much more compared to the 1.6 times EEV that was paid by France’s AXA for Winterthur. So is Aviva paying too much? Well, certainly they are; but then perhaps they feel there won’t be a third time. Now wait! Is Aviva reinsured?

For Complete IIPM - Article, Click on IIPM-Editorial Link

Source:- IIPM-Business and Economy, Editor:- Prof. Arindam Chaudhuri - 2006

No comments:

Post a Comment